Prepare to pass your FINRA Series 10 licensing exam today

Series 10 Exam Prep Study Materials

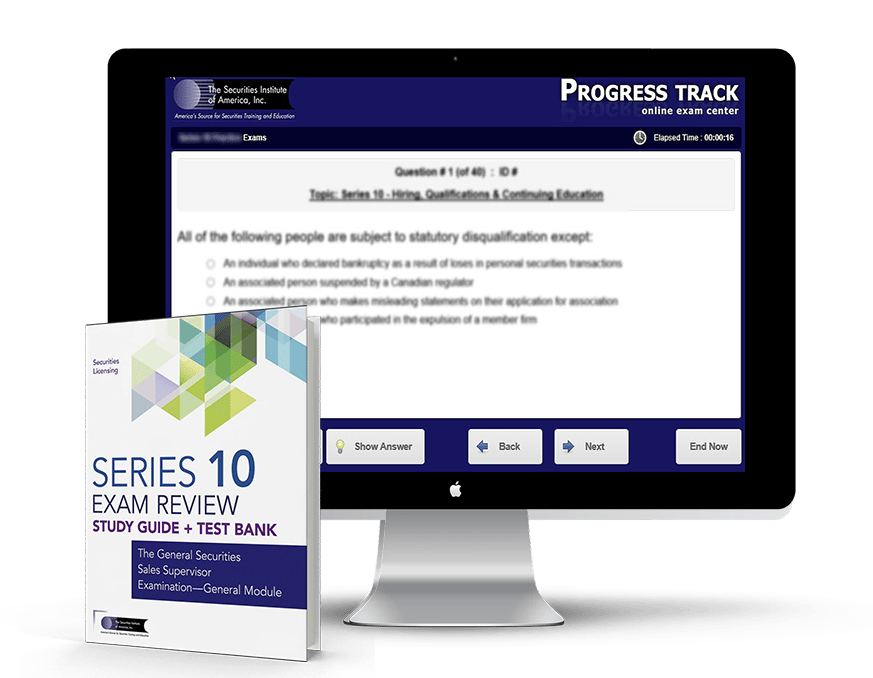

Prep for the FINRA General Securities Sales Supervisor Exam. Get exam ready with the best Series 10 study materials. Created by MSRB Experts and Compliance professionals to ensure your success. Our Series 10 Training Course includes:

Pass Rate

Over 25 years and 400,000 exams

Assured Success

If you use our practice exams

Chat & Call Support

We are with you every step of the way

Exam Review Course and Study Material highlights:

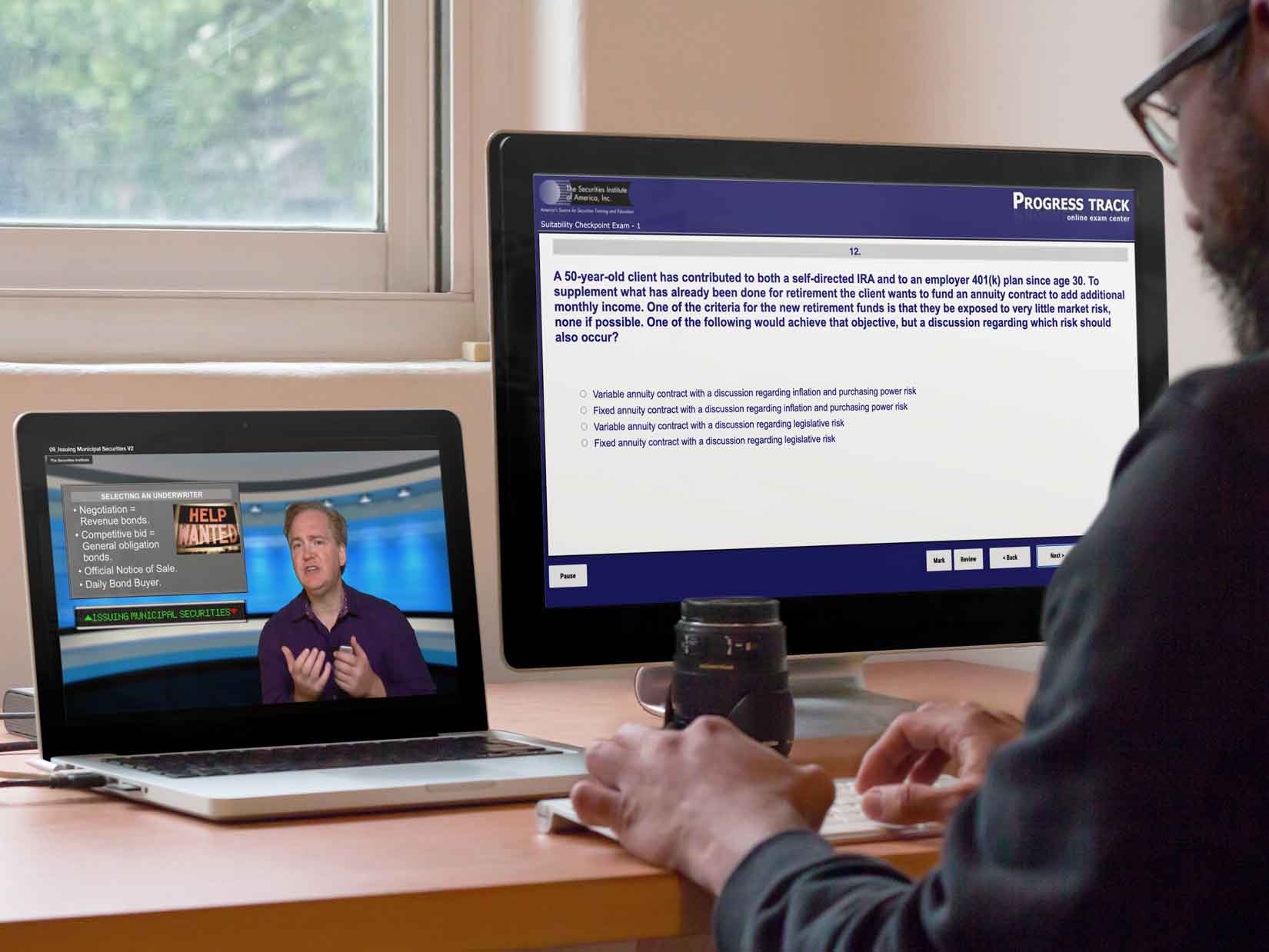

More than 12 hours of on demand video lectures. 15 videos follow our textbooks. So you know how each topic is tested on the real exam

More than 1,800 Series 10 practice questions with detailed explanations. Showing you how to master difficult questions

Our comprehensive Series 10 exam manual is the ultimate study guide. A perfect bound physical textbook packed with the information you need. And it ships free.

Series 10 Student Experience Review – Play the video on the right for more detailed Information

877-218-1776

877-218-1776

Watch Demo Video

Watch Demo Video