Prepare to pass the Series 3 licensing exam today

Series 3 Exam Prep Study Materials

Our series 3 exam prep course gets you ready to pass the exam faster, on your first attempt. This is the best rated course for the National Commodities Futures Exam. Our best in class securities exam training course features:

Pass Rate

Over 25 years and 400,000 exams

Assured Success

If you use our practice exams

Chat & Call Support

We are with you every step of the way

Series 3 Exam Review Course and Study Material highlights:

Written by series 3 test experts. Our training tools guide you through your study schedule.

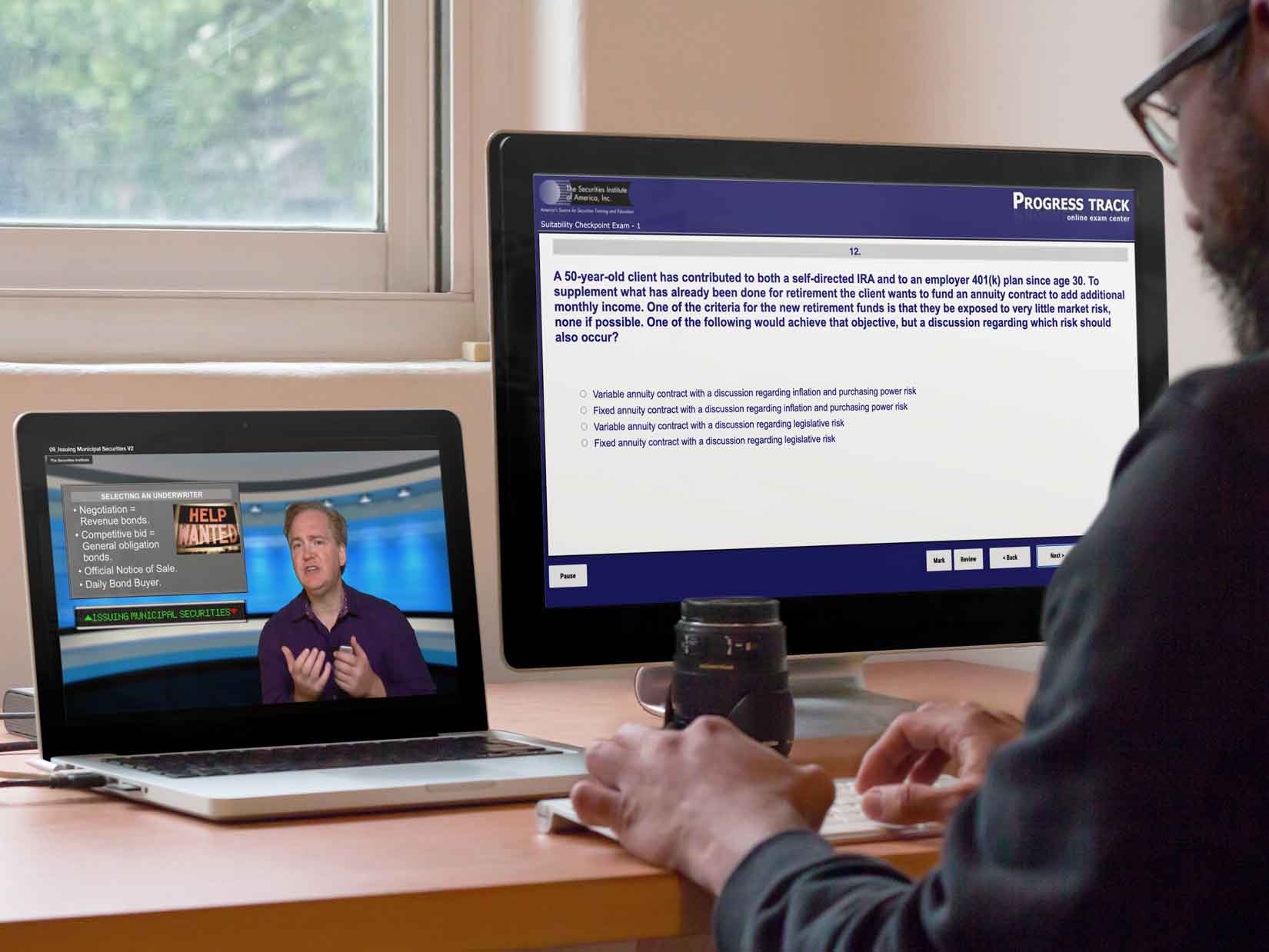

Online series 3 video class lectures follow our textbook chapter by chapter. Ensuring test takers know what to expect on exam day.

Our test questions follow the exam format and provide detailed explanations. We explain everything to help students master the concepts

Our training provides you with exam tips and the most recent content updates. Including our series 3 exam secrets and cheat sheets.

This comprehensive course ensures you are ready to ace the National Futures Associations’s NFA series 3 exam

Series 3 Student Experience Review – Play the video on the right for more detailed Information

877-218-1776

877-218-1776

Watch Demo Video

Watch Demo Video