Prepare to pass the Series 4 licensing exam today

Series 4 Exam Prep Study Materials

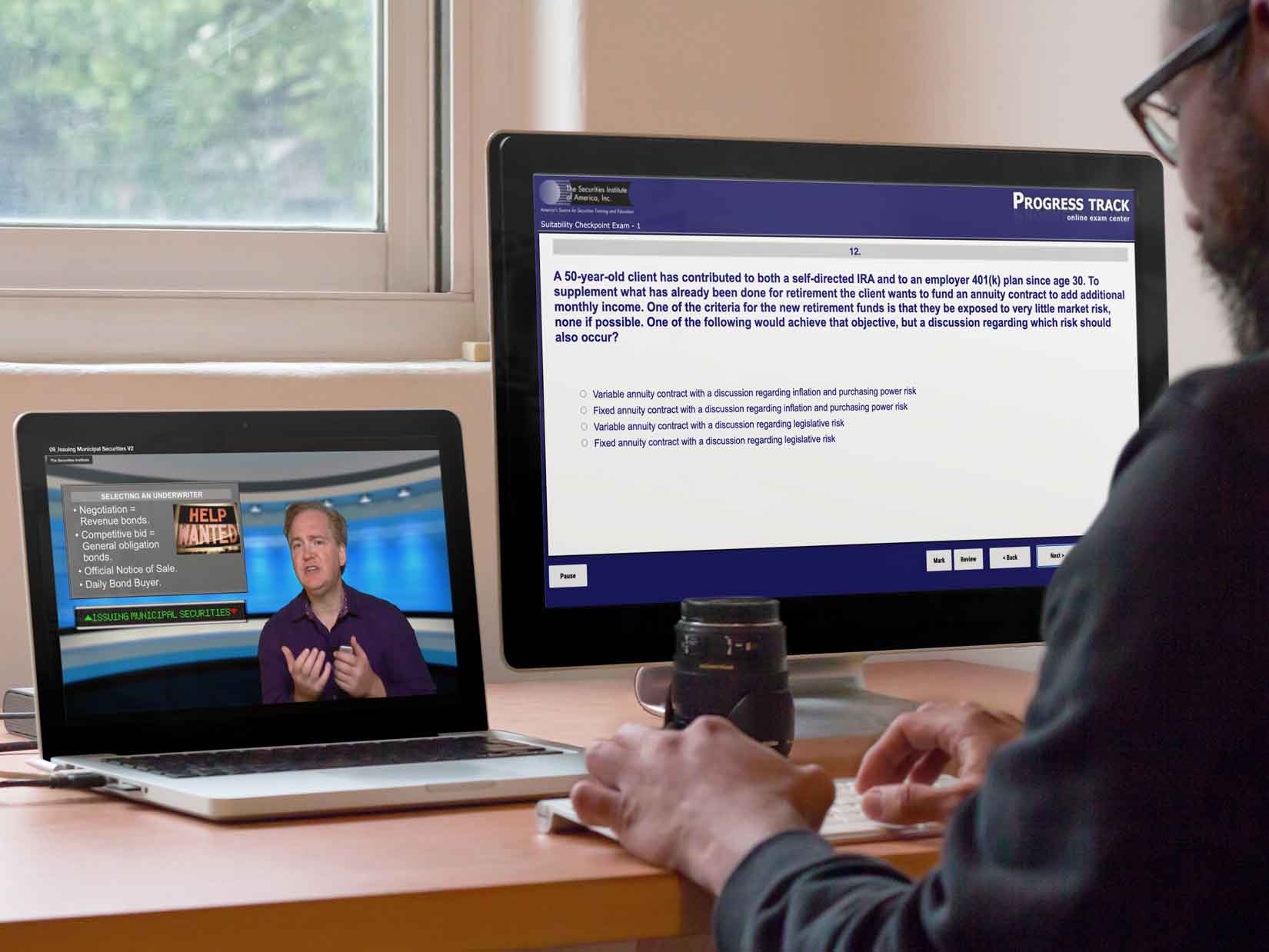

Our Series 4 exam prep materials boast the highest pass rates in the industry and will guide you through your entire exam prep process. Our best in class securities exam training course features:

Pass Rate

Over 25 years and 400,000 exams

Assured Success

If you use our practice exams

Chat & Call Support

We are with you every step of the way

Exam Review Course and Study Material highlights:

Our Series 4 exam prep materials boast the highest pass rates in the industry and will guide you through your entire exam prep process.

Passing the series 4 exam requires a mastery of complex option positions and compliance issues.

Butterfly spreads, condor spreads, collars and synthetics are made easy through expert explanation and easy to follow charts.

Written by option market makers and chief compliance officers our series 4 training materials cover every detail

877-218-1776

877-218-1776

Watch Demo Video

Watch Demo Video