Prepare to pass the FINRA Series 57 Licensing Exam Today

Series 57 Exam Prep Study Materials

Ensure you pass The Series 57 Securities Trader qualification examination. Our Series 57 training provides you with proven strategies for preparing and passing. In fact, we are so confident we offer you a money back pass guarantee. Our Series 57 Exam Prep course is the best in the industry. With the highest pass rates. Check out our Exam Review Course and Study Material highlights:

Pass Rate

Over 25 years and 400,000 exams

Assured Success

If you use our practice exams

Chat & Call Support

We are with you every step of the way

Series 57 Exam Review Course and Study Material highlights:

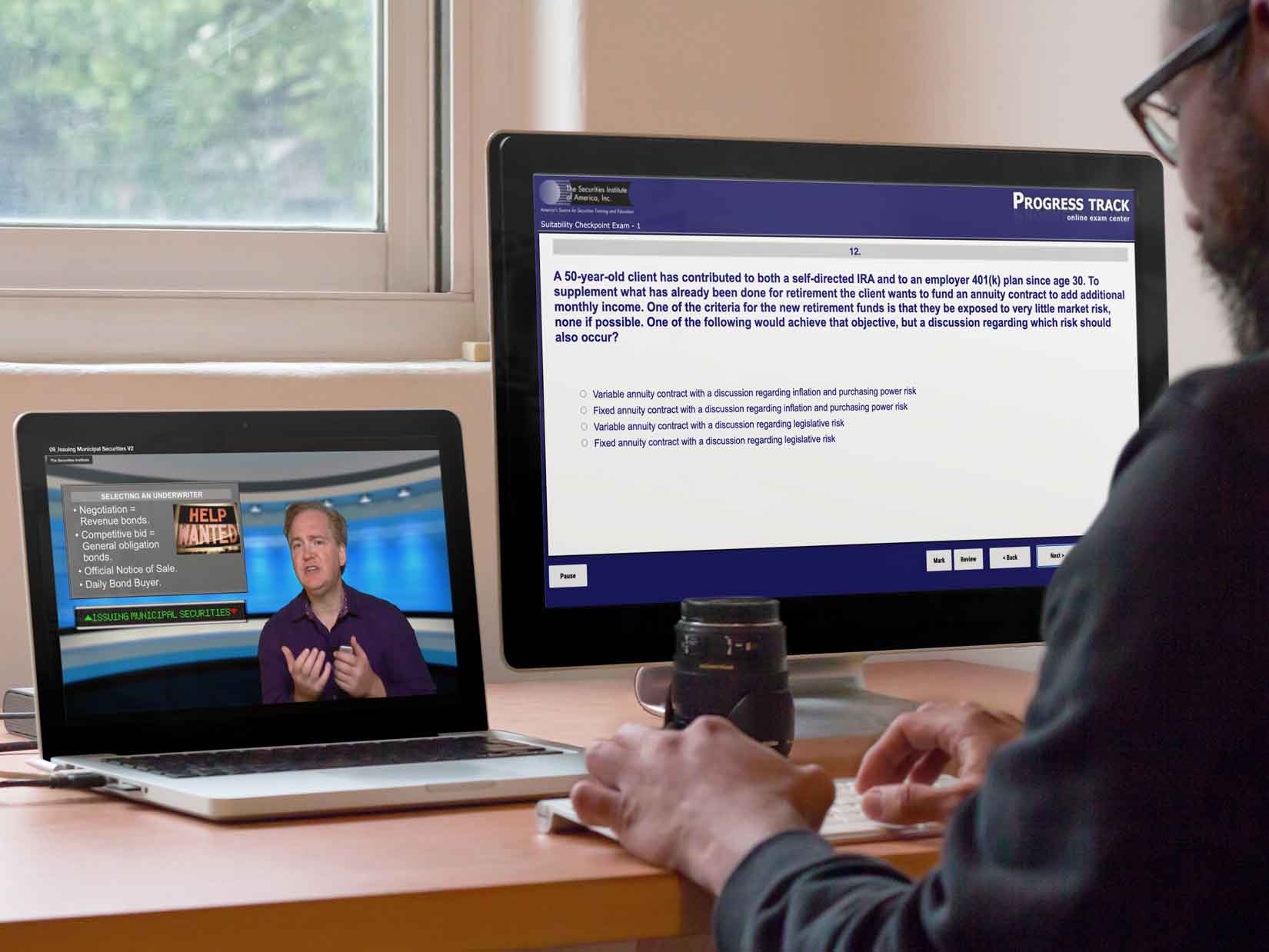

On demand high quality video training classes follow our textbooks. Explaining key concepts and how each topic is tested.

Our Series 57 training materials are written by NASDAQ traders and test prep pros. We make challenging concepts easy to understand

Ace the FINRA series 57 exam with our proven strategies for success.

Series 57 Student Experience Review – Play the video on the right for more detailed Information

877-218-1776

877-218-1776

Watch Demo Video

Watch Demo Video