Prepare to pass the NASAA Series 63 Licensing Exam Today

Series 63 Exam Prep Study Materials

Pass the NASAA Uniform Securities Agent Law Exam on your first attempt. Our training course provides you with the best series 63 study materials. Our series 63 exam prep maintains the highest pass rates in the industry. Using proven strategies for success. Our Series 63 Licensing program features:

Pass Rate

Over 25 years and 400,000 exams

Assured Success

If you use our practice exams

Chat & Call Support

We are with you every step of the way

Series 63 Exam Review Course and Study Material highlights:

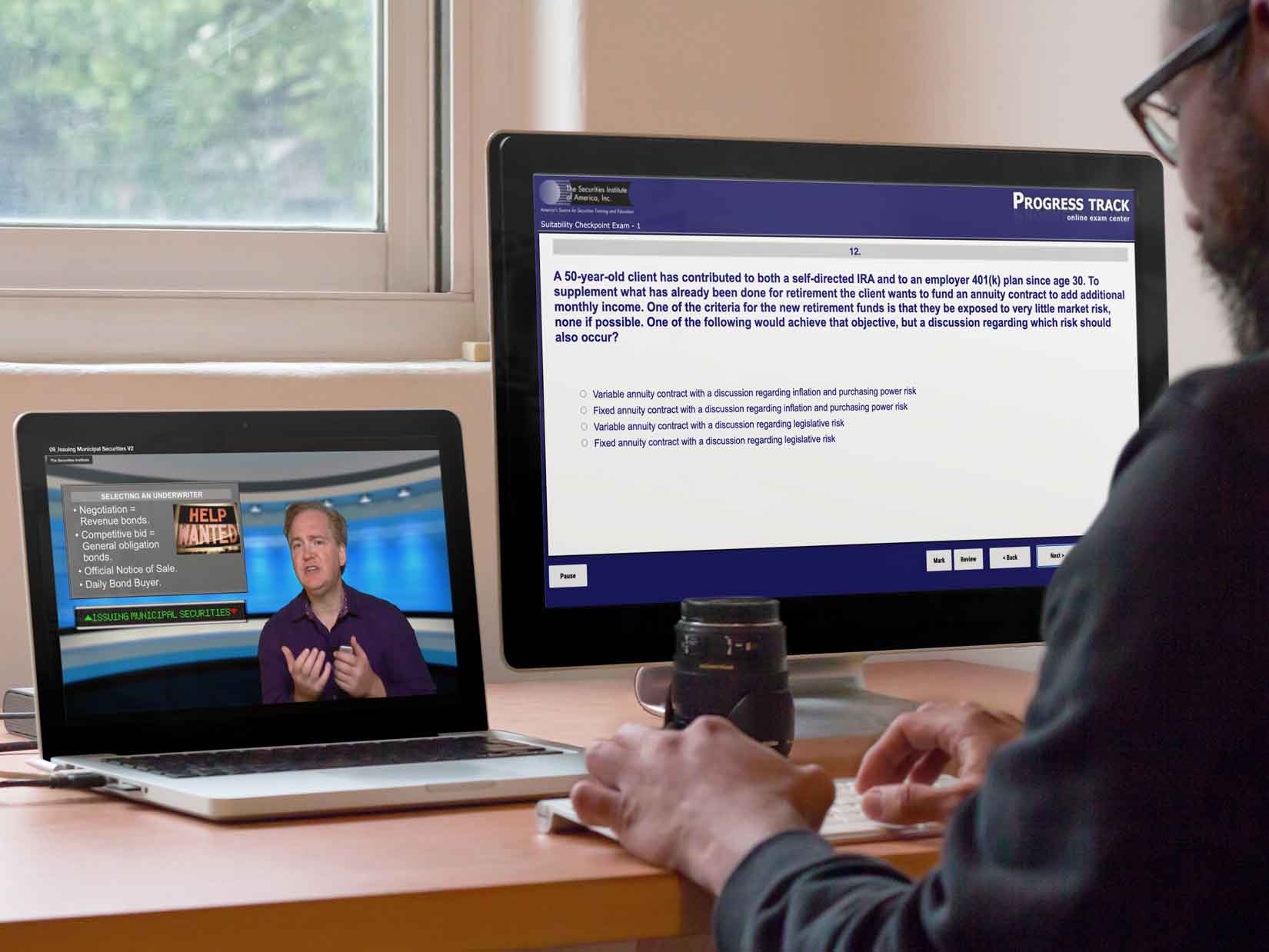

Television Quality on demand lectures that follow our textbook. We make sure you know how the topics are tested.

Comprehensive series 63 practice questions with detailed explanations. We make sure you know how the questions are asked on the actual exam.

A college quality licensing manual packed with test tips. Our series 63 exam review guide provides the details you need to be successful on exam day.

Series 63 Student Experience Review – Play the video on the right for more detailed Information

877-218-1776

877-218-1776

Watch Demo Video

Watch Demo Video