Free Series 57 Sample Exam Questions Results

You scored 50% on the free Series 57 practice questions - see below for more details.

If you have any other questions or concerns, please let us know!

Your exam results: |

|

|

|

| 50% - sorry, you failed |

| Exam: Free Series 57 Sample Exam Questions |

| Time Spent: 00 hours 5 minutes 50 seconds |

| Max. Marks: 10 |

| Marks Obtained: 5 |

| View All Series 57 Exam Prep Products | ||||

| Correct Answer Wrong Answer | ||||

| Q. No | Question | Correct Answer | Your Answer | Explanation |

|---|---|---|---|---|

| 1. | A customer enters an order for the purchase of 1,000 shares of XYAD at $30 gross. The firm changes a 30 cent per share mark up and the firm’s execution fees total 1 cent per share. At what price must the firm protect the customer’s limit order ? | 29.70 | 29.69 | A broker dealer executes a trade in a TRACE eligible security[BR]at 6:18 must report the trade to TRACE by: 8:15 AM on T+1. If a trade is executed with less than 15 minutes remaining in until the close of TRACE the trade must be reported by 8:15 AM on T +1. Saying this another way, the trade must be reported within 15 minutes of the opening of the TRACE system on |

| 2. | A customer enters an order with his rep to purchase 15,000 shares of ArGood BioTech at .931. What should the representative do will the order ? | Accept the order and input it for execution by the firm's trader | Accept the order and input it for execution by the firm\'s trader | Broker dealers are]prohibited from accepting or displaying quotes for securities in sub penny prices unless the security is quoted under $1 per share. Securities that are trading under $1 per share may be quoted in hundredths of 1 cent. .0001 |

| 3. | A customer who received 76 shares of stock as a spin off from another holding enters an order to sell the NASDAQ listed stock with his brokerage firm. Which of the following is true ? | The order may be executed via the NASDAQ terminal | The order may be executed via the NASDAQ terminal | Odd lot orders will not be displayed but may be executed over the NASDAQ terminal and the transaction will be cleared through ACT. |

| 4. | I, II, III & IV | I & III | All of the choices listed are true relating to the handling and executing of customer orders except the firm is not required to update its quote if the order is sent to a qualifying ECN. the firm is still required to protect the customer order even though it was routed to the ECN for execution. |

|

| 5. | If a firm submits a request to quote a security over the NASDAQ work station the firm will receive approval to enter quotes: | on the same day the request is made | on the same day the request is made | If a firm submits a request to quote a security over the NASDAQ work station the firm will receive approval to enter quotes on the same day the request is made. The firm must enter its initial quote within 5 days |

| 6. | OnNet.com a very volatile security listed on the NASDAQ Global market Select system is subject to a 5 minute trading pause under the Limit Up Limit Down Rule. When the stock reopens the reference price will be: | The opening price | The reference price when the stock was paused | When a security is subject to a 5 minute trading pause under the Limit Up Limit Down Rule the new reference price for the security when the stock reopens will be the opening price. 7 If a firm submits a request to quote a security over the NASDAQ work station the firm will receive approval to enter quotes |

| 7. | A broker dealer executes a trade in a TRACE eligible security at 6:18 must report the trade to TRACE by: | 8:15 AM T+1 | 8:15 AM T+1 | A broker dealer executes a trade in a TRACE eligible security[BR]at 6:18 must report the trade to TRACE by: 8:15 AM on T+1. If a trade is executed with less than 15 minutes remaining in until the close of TRACE the trade must be reported by 8:15 AM on T +1. Saying this another way, the trade must be reported within 15 minutes of the opening of the TRACE system on |

| 8. | A customer who actively trades in the markets would be classified as a pattern day trader if: | The customer executes 4 same day round trips in 5 days | The customer executes 12 same day round trips in 30 days | A customer who actively trades in the markets would be classified as a pattern day trader if the customer executes 4 or more same day round trips in 5 business days. |

| 9. | A state of limit up or limit down will be enacted if which of the following occur for 15 seconds ? I. The NBB is equal to the upper limit band II. The NBB is above the upper limit band III. The NBO is equal to the lower trading bandIV. The NBO is lower than the lower trading band | I, II, III & IV | I, II, III & IV | A state of limit up or limit down will be enacted 15 seconds if NBB (best bid) is equal or exceeds the upper limit band or if the NBO (best offer)is equal or less than the lower trading band. A five minute pause will occur during any of these scenarios after 15 seconds. |

| 10. | As it relates to the Consolidated Audit Trail System (CATS), a business day for CATS runs from: | 4:00.01 PM to 4:00 PM the next business day | 4:00.01 PM to 4:00 PM the next business day | As it relates to the Consolidated Audit Trail System (CATS), a business day for CATS runs from 4:00:01 PM until 4:00 PM the next market day |

Related Products

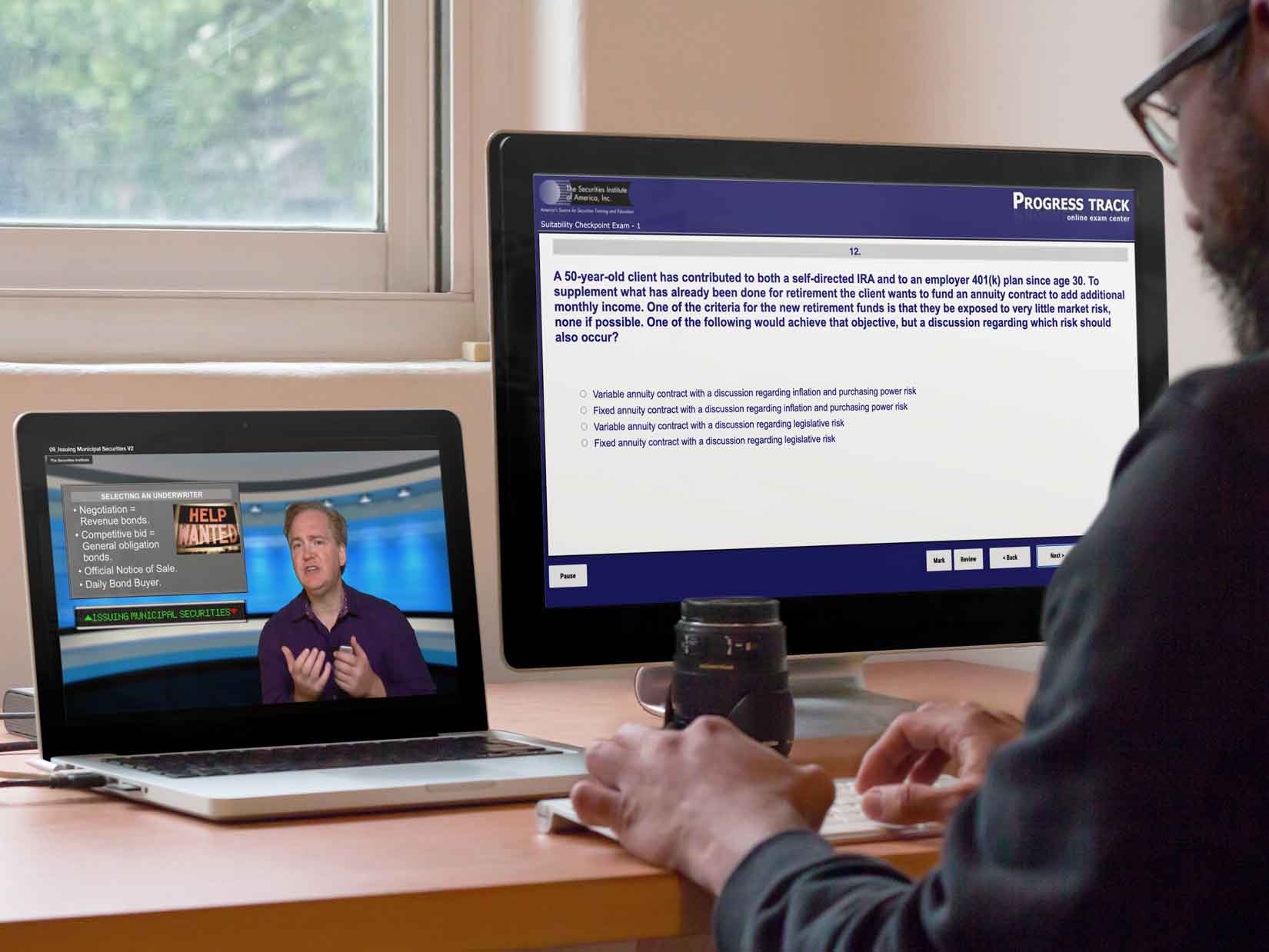

Combination Packages

All of our combination packages are discounted. Check out the prices! Purchase one of the following combination packages if you are really serious about passing your exam in the quickest possible time.

Updated on June 2025

877-218-1776

877-218-1776