Free Series 63 Sample Exam Questions Results

You scored 50% on the free Series 63 practice questions - see below for more details.

If you have any other questions or concerns, please let us know!

Your exam results: |

|

|

|

| 50% - sorry, you failed |

| Exam: Free Series 63 Sample Exam Questions |

| Time Spent: 00 hours 5 minutes 21 seconds |

| Max. Marks: 10 |

| Marks Obtained: 5 |

| View All Series 63 Exam Prep Products | ||||

| Correct Answer Wrong Answer | ||||

| Q. No | Question | Correct Answer | Your Answer | Explanation |

|---|---|---|---|---|

| 1. | A broker dealer registered to conduct business in 15 states with $200,000 in net capital is subject to all of the following except: | $35,000 surety bond requirement | $35,000 surety bond requirement | A broker dealer who meets the SEC’s net capital requirement is not subject to the $35,000 surety bond requirement. |

| 2. | I & III | I & IV | Only the company selling securities in its home state for the first time and the two year old company who had sold securities in four other states would be required to register through qualification. Even though the ten year old company meets some of the requirements to register through notification, they are selling securities for the first time in their home state only. |

|

| 3. | A local appliance store is promoting it annual Fourth of July sale. It has significantly marked down large screen TVs. Also, anyone who purchases a large screen TV will receive a $100 US Savings Bond. Which of the following is true? | The salesman at the store need not register, as the savings bond is an exempt security | The salesman at the store must be registered, as the gift of the bond attached to a sale is considered a sale | The US savings bond is an exempt security and the sales person does not need to register. The practice of offering savings bonds during a promotion is not fraudulent or in violation of the USA. |

| 4. | A New York agent representing a New Jersey broker dealer has several clients in Pennsylvania and three clients in Florida. Where must the agent be registered ? | New York, New Jersey, Pennsylvania, and Florida | New York, New Jersey, Pennsylvania, and Florida | The agent must register in their home state, in their state of employment and in the states where they have clients. |

| 5. | A regional firm is acquiring a local firm in state. The regional firm is not registered as a broker dealer in the state of the firm that it is acquiring. All of the following are true except: | The acquiring firm will have to pay new registration fees | The acquiring firm will have to pay new registration fees | All of the answers listed are true except that the firm will have to pay new registration fees. The acquiring firm will pay the registration fees at year end for the next year. |

| 6. | All but which of the following is true about the National Securities Market Act of 1996? | It requires that advisers with assets under management of $100,000,000 or more must register with the state government only; they must notify the federal government and pay a federal filing fee only | The National Securities Market Act of 1996 requires that investment advisers with assets under management of $100,000,000 or more must register with the federal government, the SEC, and notify the state and pay a state filing fee in the states where they do business. |

|

| 7. | I, II, & IV | I & III | An adviser is considered to have custody if they have full discretion to withdraw cash and securities as well as when they accept customer’s securities for deposit. An adviser that self-clears holds all of the customer’s cash and securities. |

|

| 8. | An agent who has passed their Series 63 but has not yet received notification from the state may do which of the following ? | None of the above | None of the above | An agent may not do any of the choices listed until they have received notice of registration. |

| 9. | IV only | IV only | The commercial paper is only given a federally covered exemption if it is less than 270 and sold in denominations of $50,000 or more. The agent in this case is selling the commercial paper to the public and receives a fee when it is sold and therefore must register. |

|

| 10. | Under the provisions of the Uniform Securites Act an investment adviser is which of the following ? | A publisher of market letter with a $400 annual subscription price, who basis the letter on market conditions | J. Smith, the owner of J. Smith advisers | A publisher of market letter who basis the letter on market conditions is considered an investment adviser. |

Related Products

Combination Packages

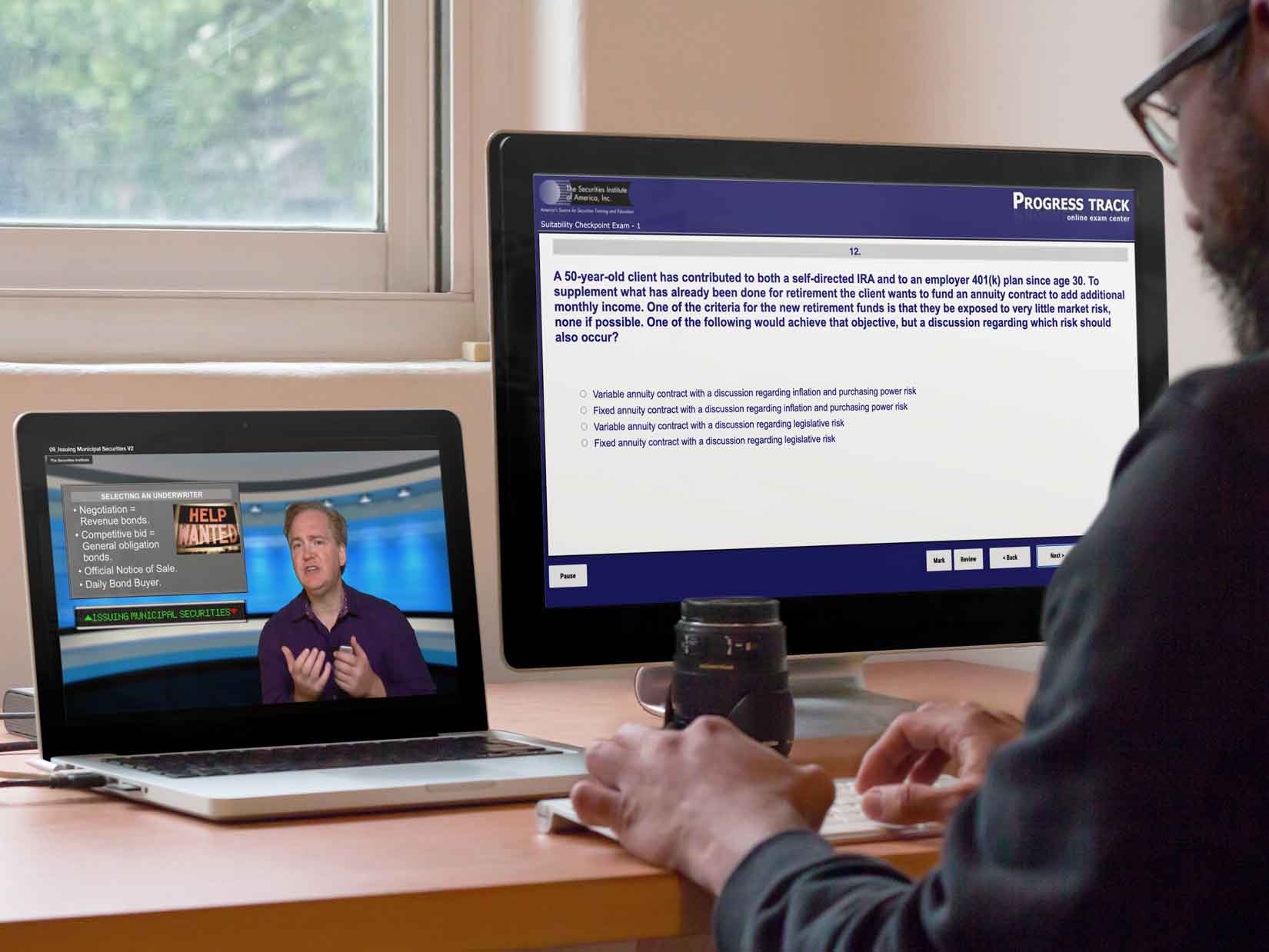

All of our combination packages are discounted. Check out the prices! Purchase one of the following combination packages if you are really serious about passing your exam in the quickest possible time.

877-218-1776

877-218-1776