Prepare to pass the NASAA Series 66 Licensing Exam Today

Series 66 Exam Prep Study Materials

Prepare to pass The NASAA Series 66 Uniform Combined Law Examination. Our Prep Course is the ultimate guide for achieving success on the series 66 exam. Our series 66 prep materials deliver the highest pass rates in the industry. In fact, we guarantee you pass. Check out our Series 66 Securities Training Course Highlights:

Pass Rate

Over 25 years and 400,000 exams

Assured Success

If you use our practice exams

Chat & Call Support

We are with you every step of the way

Series 66 Exam Review Course and Study Material highlights:

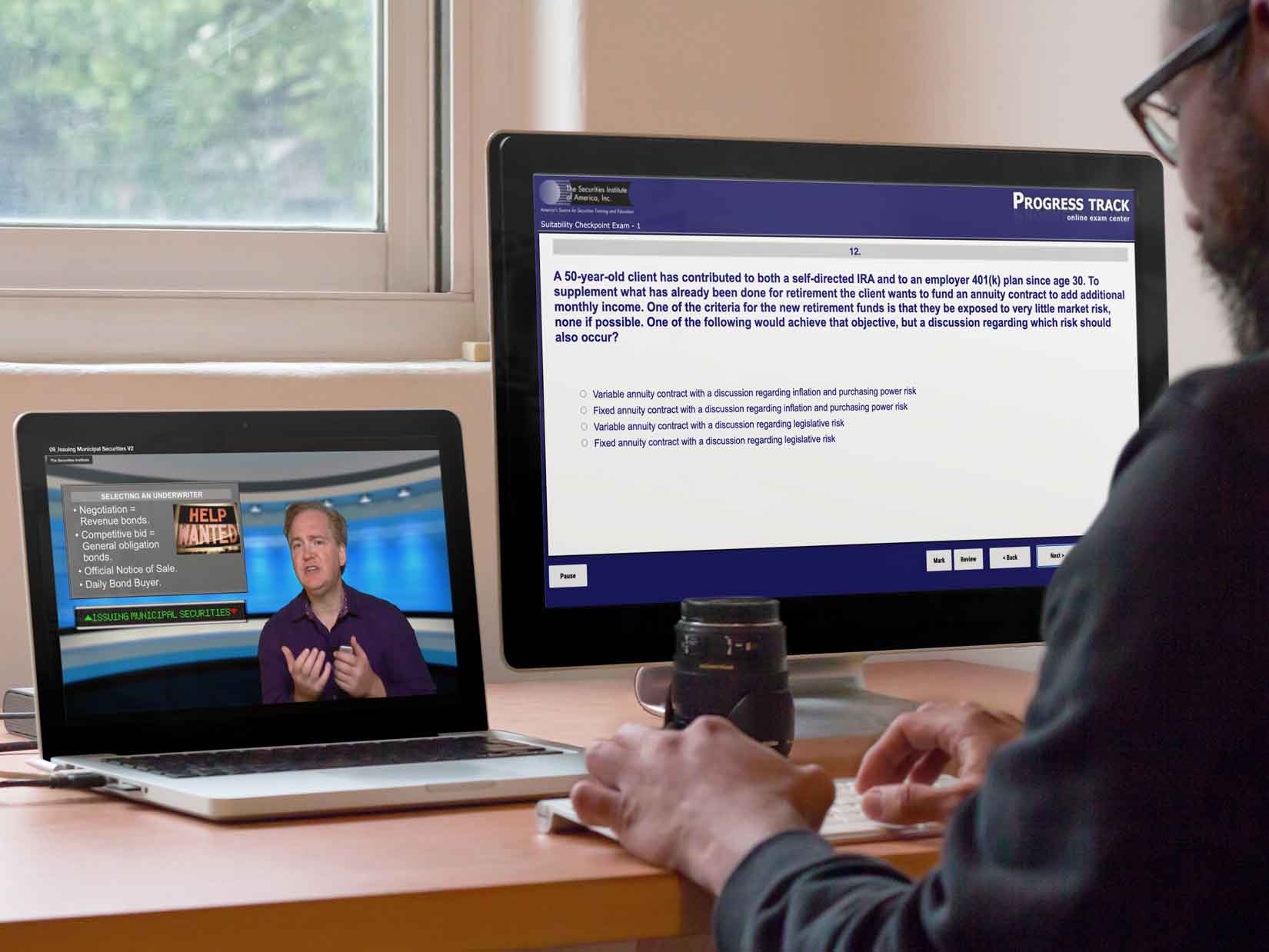

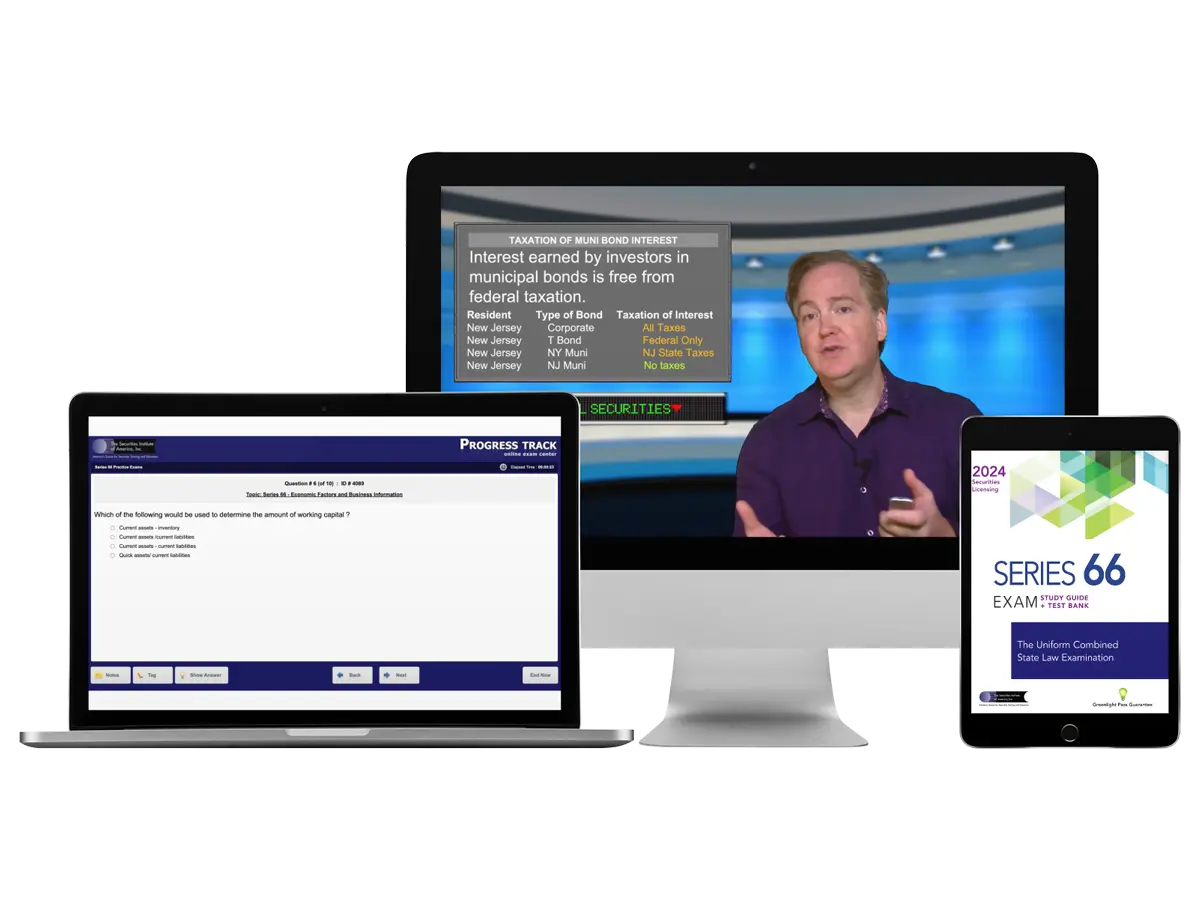

Our Online Video Class Training follows our textbook chapter by chapter. Showing you how each topic is tested on the actual exam.

Series 66 practice questions, Checkpoint Exams and Final Exams Ensure you have mastered the material. We explain everything.

Our Series 66 exam secrets, test tips and cheat sheets get you ready for the real test. Focusing on import exam topics and key concepts.

Our series 66 study materials ensure you are ready to pass. Providing the most up to date and exam focused course content.

Series 66 Student Experience Review – Play the video on the right for more detailed Information

877-218-1776

877-218-1776

Watch Demo Video

Watch Demo Video