Free Series 7 Sample Exam Questions Results

You scored 30% on the free Series 7 practice questions - see below for more details.

If you have any other questions or concerns, please let us know!

Your exam results: |

|

|

|

| 30% - sorry, you failed |

| Exam: Free Series 7 Sample Exam Questions |

| Time Spent: 00 hours 5 minutes 30 seconds |

| Max. Marks: 10 |

| Marks Obtained: 3 |

| View All Series 7 Exam Prep Products | ||||

| Correct Answer Wrong Answer | ||||

| Q. No | Question | Correct Answer | Your Answer | Explanation |

|---|---|---|---|---|

| 1. | XYA a manufacturer of computer circuit boards has $50,000,000 worth of subordinated debentures outstanding. Each debenture carries an interest rate of 6.5% and has warrants attached to the debenture to purchase 5 shares of XYA at $25 per share. XYA’s stock is trading in the marketat $28 per share and the warrants are about to expire. The company would expect to receive proceeds of: | $6,250,000 | $7,500,000 | There are 50,000 $1,000 par bonds (50,000,000 / 1000) outstanding each bond has warrants attached to purchase 5 shares of stock at $25 per share. The company would expect that all of the warrants will be exercised as the warrants are in the money and about to expire. As a result the company would expect to issue 250,000 new shares at $25 and receive proceed of $6,250,000 |

| 2. | II only | III and IV | A facility with an outstanding bond issue with an open end covenant may issue bonds with the same claim on the facility and its revenue. The new issues will be subject to an additional bonds test to make sure that the revenue received by the facility can support the total outstanding debt. The new issue will not be subject to a mandatory sinking fund and there is no amortization requirement |

|

| 3. | A custodial account being managed for the benefit of a minor is long 500 shares of BNM. BNM is offering new shares to finance the building of a new factory. Each share of BNM will receive 1 right to purchase the new BNM shares. It takes 2 rights plus $28 dollars per share to purchase the new BNM shares. BNM is trading in the market place at $30. What is the value of each right? | $1 | $2 | To determine the value of the right subtract the subscription price from the market price and divide by the number of rights required to purchase 1 share as follows: $30-$28 = $2 $2/2 = $1 |

| 4. | A long term growth oriented investors is long 400 shares of EXT at $19. The stock over the last three years has appreciated to $74 and the company declares a 3:2 stock split. The investor’s account will receive how many additional shares of EXT on the payable date? | 200 | 400 | To determine the number of shares the investor will own after the split multiply the number of shares owned by the split. In this case 400 X 3/2 = 1200 / 2 = 600 shares. As the investor is long 400 the investor will receive an additional 200 shares |

| 5. | A US importer is buying $10,000,000 worth of goods from a Japanese manufacturer. The payment will be made 6 months from now in Japanese Yen. To hedge themselves the US importer would do which of the following ? | Buy Calls on the Japanese Yen | Buy Calls on the Japanese Yen | US importers will always buy calls on the foreign currency to hedge themselves. The Dollar based answer is always wrong. There are no options trading on the US dollar in the US. |

| 6. | A well-established agent who lives in New Jersey and commutes to his office in New York City is working out of his vacation home in Florida during the winter. How long can the agent work out of his vacation home without working in a branch office? | 30 days | 60 days | The agent may work out of his vacation home for 30 days without being required to report to a branch office |

| 7. | III and IV | III and IV | A sale of 5,000 shares or less with a value of $50,000 or less is exempt from the filing requirements of Rule 144. If the number of shares exceed 5,000 or the value was greater than $50,000 form 144 would have to be filed at the time the order is entered |

|

| 8. | An investor buys 10 XYZ May 70 calls at 3.10 when XYZ is at 68. At expiration the stock is at 77 and the investor closes out the position at its intrinsic value. What is the profit or loss ? | $3,900 profit | $7,000 profit | The options are worth $7,000 at expiration. They paid $3,100 to establish the position. Therefore the profit is $3,900. |

| 9. | An investor owns $50,000 worth of US T’ bonds with an interest rate of 5%. The investor is in the 30% tax bracket at the federal level and 9% at the state level. Based on the income, the investor will have a tax liability of: | $750 | $750 | Interest on US T bonds is not taxed at the state or local level. The interest is only taxed that federal level. In this case the investor earned $2,500 in interest and is in the 30% tax rate. The tax liability is $750. ($2,500 X 30%) |

| 10. | An uncle had established and contributed to a Coverdell ESA for his nephew’s college education for the last 10 years. The nephew withdraws $7,000 from the growth of the account to meet $5,000 worth of educational expenses. The remaining $2,000 is: | Taxable to the nephew | Taxable to the uncle | The excess distribution from the account and is taxable to the beneficiary as it was not used to pay for educational expenses |

Related Products

Combination Packages

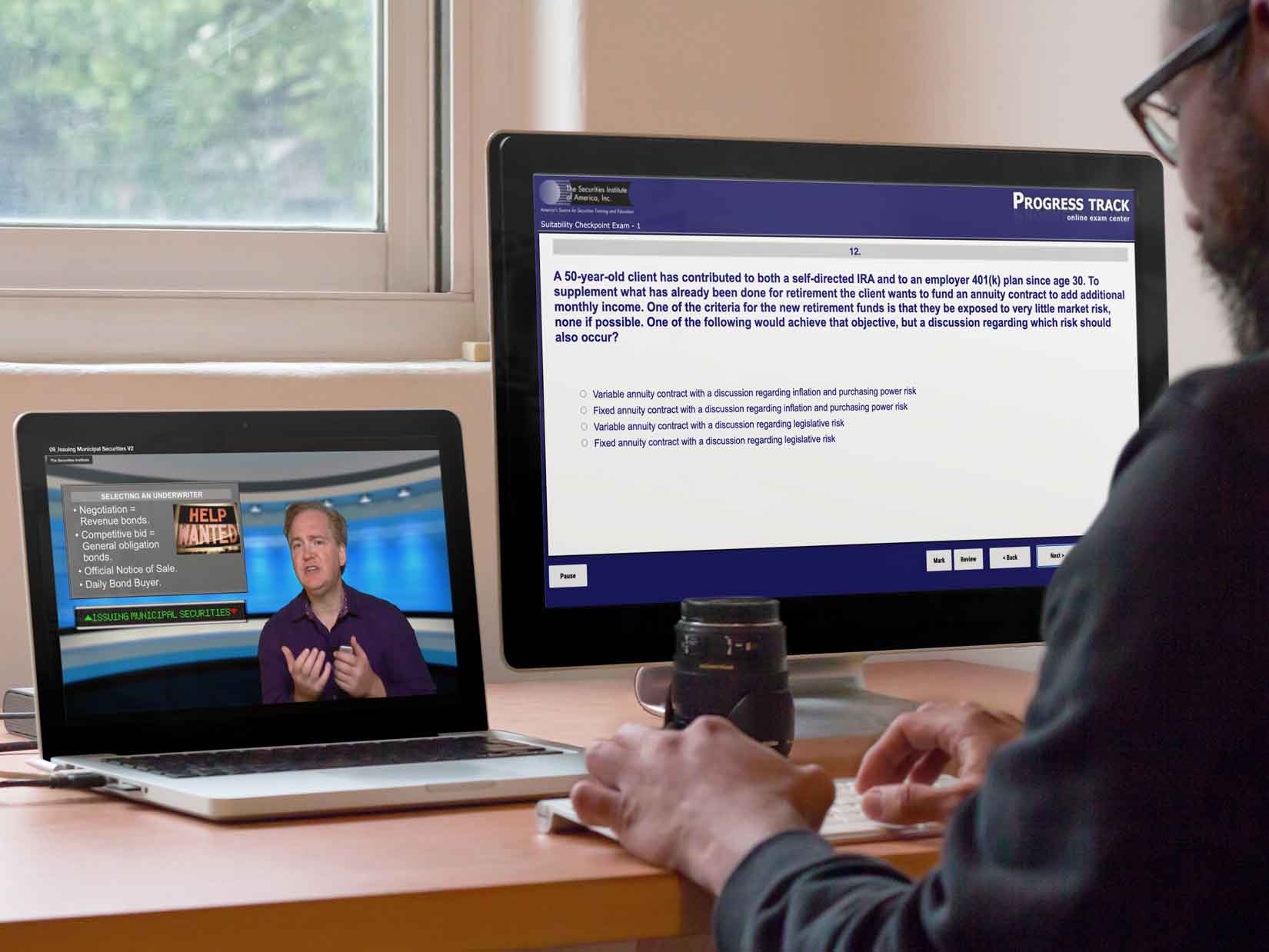

All of our combination packages are discounted. Check out the prices! Purchase one of the following combination packages if you are really serious about passing your exam in the quickest possible time.

Updated on June 2025

SIE Exam and Series 7 Top Off Exam Complete Self Study Solution

Updated on June 2025

SIE, Series 7 & 63 Complete Study Solution

Updated on June 2025

Series 7 and 63 Complete Self Study Solution

Updated on May 2025

Series 7 & Series 63 Bundled Package

Updated on May 2025

Series 7 and 63 Complete Video Package

Updated on June 2025

SIE, Series 7 & 66 Complete Study Solution

Updated on June 2025

Series 7 and 66 Complete Self Study Solution

Updated on June 2025

Series 7 and Series 66 Bundled Package

Updated on May 2025

Series 7 and 66 Complete Video Package

Updated on June 2025

877-218-1776

877-218-1776