Prepare to pass your series 65 licensing exam today

Buy The Best Series 65 Exam Prep Study Materials

The best Series 65 exam prep course. We are ranked #1. Our comprehensive guide to Series 65 Exam Prep gets you ready for the real test. Our Exam Review Course and Series 65 Study Material hghlights:

Pass Rate

Over 25 years and 400,000 exams

Assured Success

If you use our practice exams

Chat & Call Support

We are with you every step of the way

Series 65 Exam Review Course and Study Material highlights:

Our Series 65 study materials boast the highest pass rates in the industry. We guide you through your entire exam prep process.

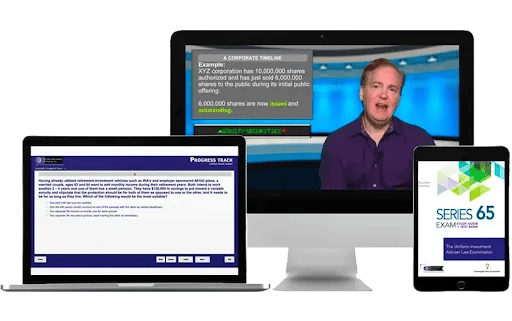

Our Series 65 textbook, test questions and video classes work with you. We explain each concept, step by step.

Our online Series 65 video class lectures follow our books chapter by chapter. Detailing each topic ensuring you know what to expect on exam day.

Our Series 65 test prep materials come with our money back GreenLight Guarantee ™

We ensure you are ready to pass The NASAA Uniform Investment Adviser Law Exam. Providing Essential Tips and Techniques for Preparation

Series 65 Student Experience Review – Play the video on the right for more detailed Information

877-218-1776

877-218-1776

Watch Demo Video

Watch Demo Video