SIE Sample Exam Questions Results

You scored 50% on the free Sie exam practice questions - see below for more details.

If you have any other questions or concerns, please let us know!

Your exam results: |

|

|

|

| 50% - sorry, you failed |

| Exam: SIE Sample Exam Questions |

| Time Spent: 00 hours 8 minutes 35 seconds |

| Max. Marks: 10 |

| Marks Obtained: 5 |

| View All Sie exam Exam Prep Products | ||||

| Correct Answer Wrong Answer | ||||

| Q. No | Question | Correct Answer | Your Answer | Explanation |

|---|---|---|---|---|

| 1. | A business cycle is defined as having how many distinct stages? | 4 | 4 | The business cycle has four distinct stages: expansion, peak, contraction, and trough. |

| 2. | A company may pay dividends in which of the following ways? | All of the above | All of the above | A company may pay a dividend in any of the ways listed. A company may pay a dividend in cash, product shares of its own stock or stock of a subsidiary. |

| 3. | Authorized stock is all of the following except: | Arbitrarily determined at the time of incorporation and may not be changed | Arbitrarily determined at the time of incorporation and may not be changed | If the shareholders vote and approve an increase in the number of authorized shares, then more stock may be issued. |

| 4. | In order for a representative to join a new firm, the old member must fill out and submit a: | U-5 | U-5 | In order to terminate a representative’s association with a member, that member must fill out and submit a U-5 to FINRA. |

| 5. | Straight preferred stock and cumulative preferred stock differ in what way? | If a company cannot pay dividends for two years, the straight preferred stockholder is not owed arrears, while the cumulative preferred stockholder is owed arrears first | If a company is in financial difficulty and cannot pay dividends for a year or two, the straight preferred stockholder is owed nothing, while the cumulative stockholder is owed arrears, before the common stockholders are paid anything. |

|

| 6. | The federal funds rate is the rate: | That banks charge each other for overnight loans, and is subject to daily change | Major commercial banks charge brokerdealers for margin account loans | The federal funds rate is what banks charge each other for overnight loans. Choice A describes the discount rate; Choice B describes the prime rate; Choice D describes the broker call loan rate. |

| 7. | When a corporate issuer is granted an effective date by the SEC it means that: | The SEC has received the required documentation | The SEC has approved the securities for sale to the public | The SEC disclaimer specifically states that they do not endorse or guarantee anything that relates to the issuer or its securities. When the SEC ends the cooling off period by granting the issuer an effective date it is because they have received all the necessary documentation from the issuer. |

| 8. | Which of the following only relates to the fixed income securities of an issuer ? | Credit risk | Purchasing power risk | Credit risk is the risk of default, which only relates to fixed income securities. This is the risk that the issuer does not pay interest or principal on time. |

| 9. | Which of the following securities does not pay a dividend? | Warrant | Warrant | Warrants represent long term opportunities to buy stock at a fixed price, and do not pay dividends. All other securities listed potentially pay dividends. |

| 10. | You note that help wanted ads in the Wall Street journal have been increasing. This economic measure is a: | Leading indicator | Co-incident indicator | The number of employment ads is viewed as a leading indicator which will predict a change in the economy. The duration of unemployment claims is considered a lagging indicator, a result of a change in the economy. |

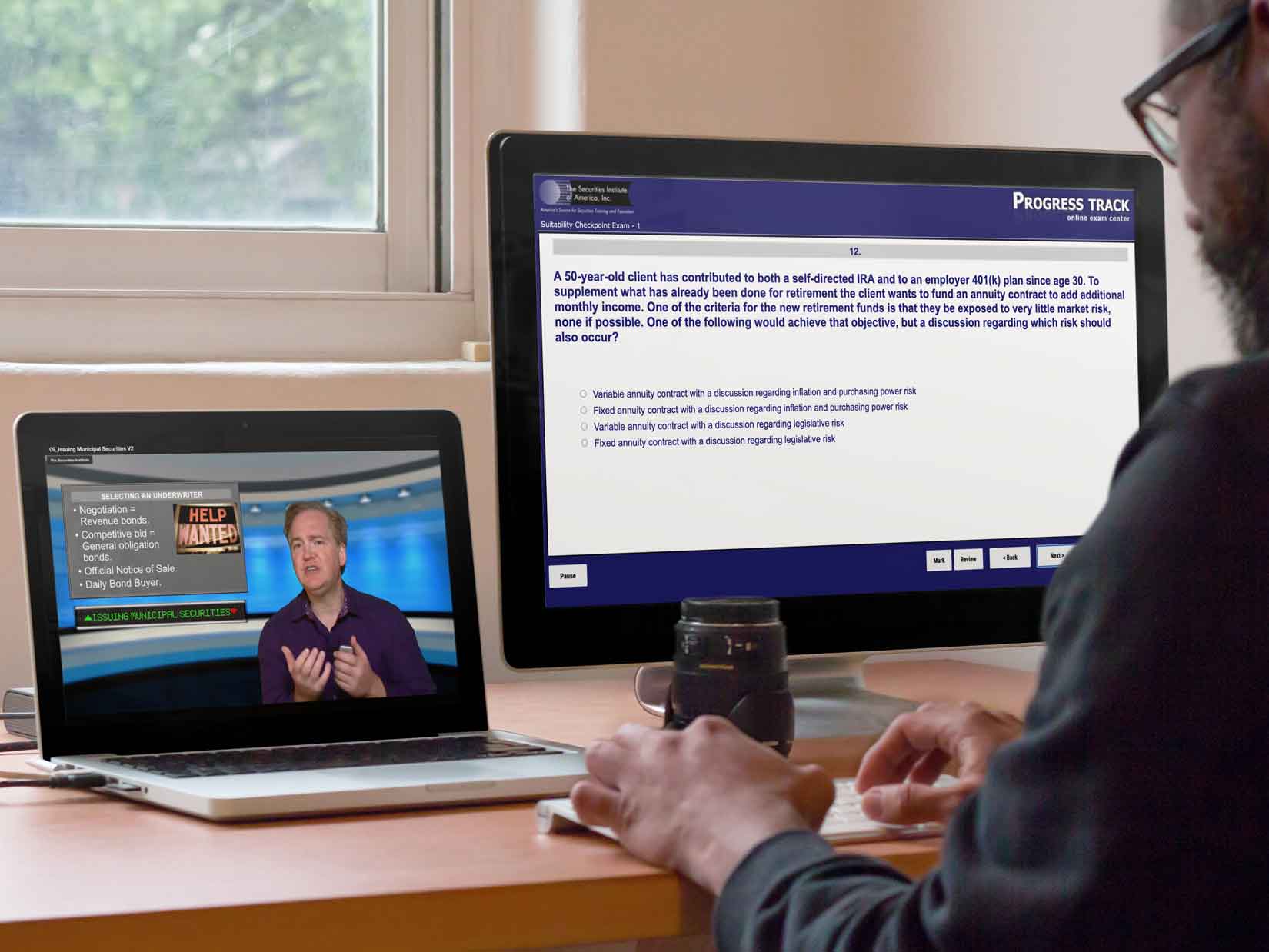

Related Products

Combination Packages

Updated on June 2025

SIE Exam and Series 6 Top Off Exam Complete Self Study Solution

Updated on June 2025

SIE Exam and Series 7 Top Off Exam Complete Self Study Solution

Updated on May 2025

SIE and Series 22 Complete Study Solution

Updated on June 2025

SIE and Series 57 Complete Study Solution

Updated on June 2025

SIE and Series 79 Complete Self Study Solution

Updated on December 2025

SIE, Series 79 and 63 Complete Self Study Solution

Updated on June 2025

877-218-1776

877-218-1776