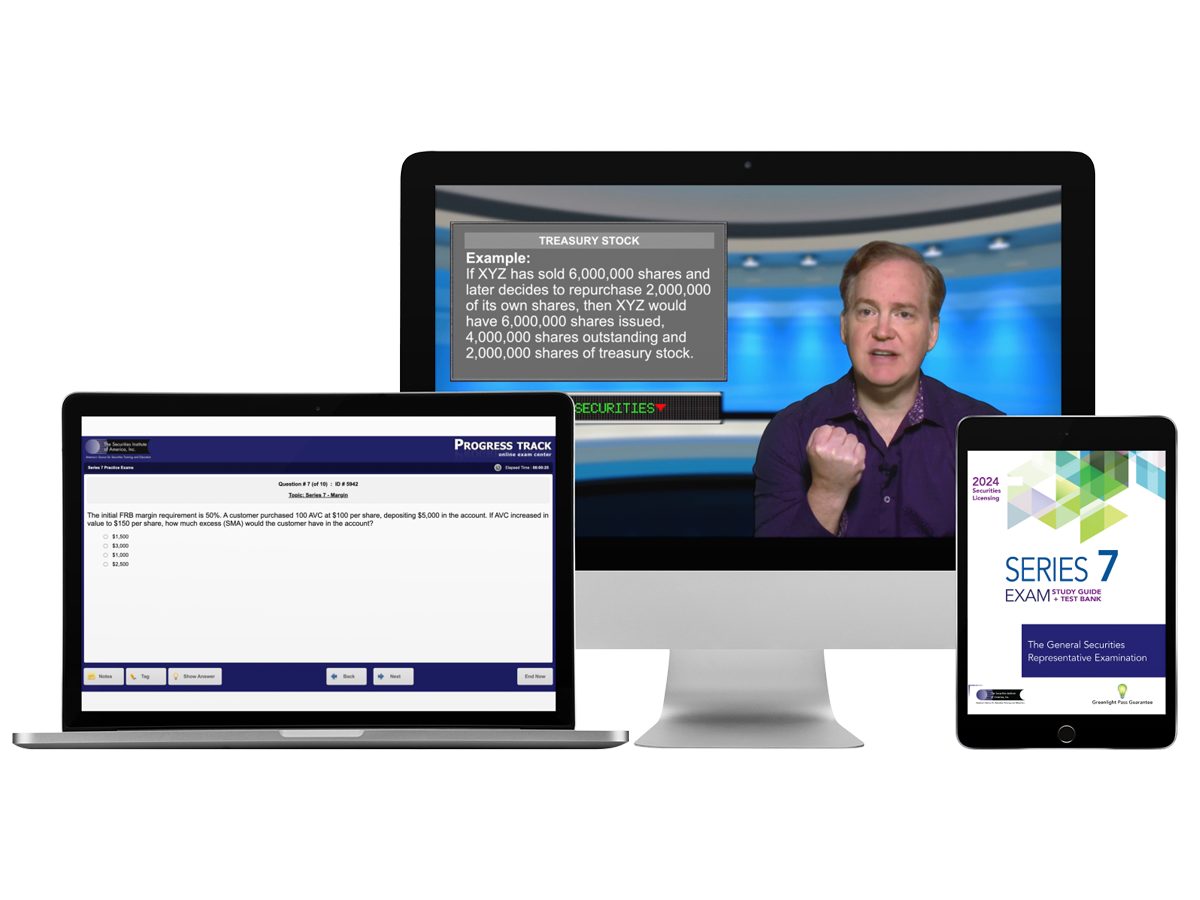

Prepare to pass the series 7 Top off exam with our best in class study materials. Created by experts. Our comprehensive series 7 training program provides you with the tools you need to pass. The first time. Exam Review Course and Study Material highlights:

Become a master in options, municipal securities, suitability and all things series 7, with our most comprehensive study materials

$289.00

$ 289.00

$ 194.95

$ 149.00

Series 7 Combination Packages

All of our combination packages are discounted. Check out the prices! Purchase one of the following combination packages if you are really serious about passing your exam in the quickest possible time.

2024 © Securities Institute, All Rights Reserved.

Privacy Policy | Terms of Service.